If you have money in a foreign financial account and you are a citizen, or you have a mutual fund, brokerage account, trust, or other type of financial account overseas, you may have to report this money to the Treasury in the US. US citizens with financial interests in other countries come under the law of FBAR, the Foreign Bank Account Report.

Facts about FBAR

Just exactly what is FBAR? US citizens with overseas financial holdings must annually fill out the Financial Crimes Enforcement Network (FinCEN) 114 form, Report of Foreign Bank and Financial Accounts (FBAR). FBAR must be filed electronically every year by June 30 – you will need to fill out this form if you have over $10,000 in assets that are held outside the US. FBAR applies to citizens and residents of the United States, whether they live in the US or live abroad. Therefore, FBAR has the potential to affect millions of Americans whether they have decided to spend their lives abroad, or choose to live at home.

FBAR: Who Needs to File?

FBAR may appear complicated at first glance. But it is important to get it right – the penalties for non-filing are high. You need to file an annual FBAR if you have a financial interest in, or are a signature authority for, a financial account which is located outside of America. You must also have in excess of $10,000 in this account or accounts in order to be required to file. This amount must be exceeded at any point in the year which is being reported. You need to file if you are a US citizen, resident, or US entity.

There are some exceptions to FBAR filing – check the IRS FBAR guidance for more details. For example, if a certain foreign account is jointly owned by spouses it may be considered an exception. Certain accounts owned by international financial institutions or governments are not applicable.

If you hold money in a foreign financial account you need to report even if there is no taxable income associated with the amount.

How to File for FBAR

You need to file FBAR every year. It must be submitted and received on or before June 30 of the year after the calendar year which is being assessed. The system of filing FBAR is electronic and it is separate from a federal tax return.

It is important to consider that even if you get an extension from the IRS for an income tax return, this extension does not apply to FBAR. There is no way to get an extension on the FBAR filing.

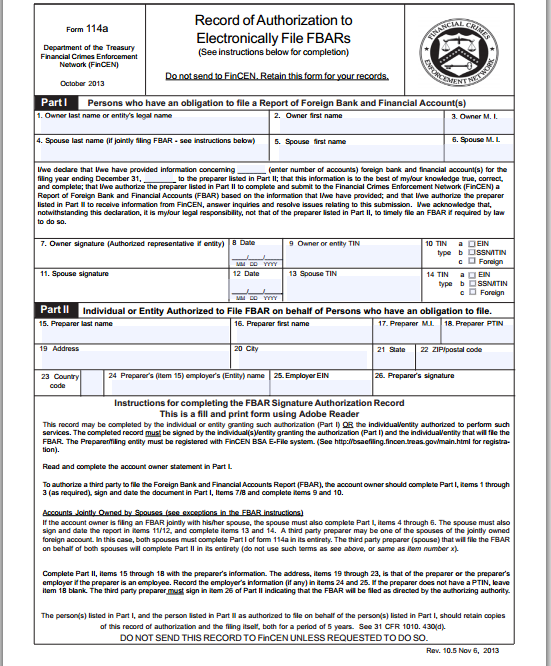

The electronic filing method for FBAR came into effect in 2013. The E-Filing System is maintained by the US Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) and the electronic FBAR is called FinCEN 114. E-filing for FBAR takes place through the following link: http://bsaefiling.fincen.treas.gov/NoRegFBARFiler.html You first register with the system, set up an online account, and then file your FBAR. You can have a tax consultant file your FBAR for you. In order to have someone else, such as your spouse or your accountant, fill out the FBAR for you, you need to register this preference on Form 114a.

FBAR Penalties

Failure to properly file an FBAR when you need to results in steep penalties. You may receive a fine of $10,000 if you are required to fill out the FBAR and you do not do so. This fine reflects a non-willful violation – if the violation is willful then the penalty is steeper and can reach $100,000 or 50 percent of the account’s balance. Individuals may also be imprisoned. If you are concerned about circumstances, such as natural disasters, which may affect timely filing of FBAR then you need to consult the FBAR IRS guidelines.

In recent years, the IRS has been extremely tough on individuals and institutions that do not comply with the accurate reporting of finances overseas. You need to report the income even if it is also taxed overseas. You cannot claim ignorance of foreign accounts in order to get away with non-filing. The IRS says that any individual making a conscious effort to avoid discovering or knowing about their foreign accounts is liable to be fined for willful non-reporting. Do make sure you are compliant, and if necessary, consult a tax professional.